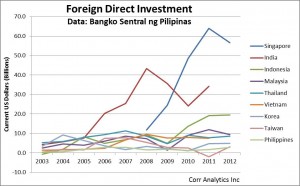

Figure 1: China and Philippines: Military Expenditure and Energy Use, 1989-2011. Shortly after most US forces left the Philippines in 1991-2, Chinese military expenditure and activity in the South China Sea increased dramatically. Data source: Correlates of War Project.

Journal of Political Risk, Vol. 1, No. 3, July 2013.

By Anders S. Corr, Ph.D., and Priscilla A. Tacujan, Ph.D.

The Philippine government is constitutionally required to craft an independent foreign policy, but it must accelerate cooperation with foreign powers to do so effectively. China’s growing militarization and energy consumption are fast out-pacing the meager military spending and energy consumption of the Philippines (See Figure 1). This makes China, more so than the Philippines, willing to risk military conflict over disputed energy resources, fishing areas, and transportation routes in the South China Sea. Continue reading